This series builds off each volume, so if you haven’t read The Intelligent Fantasy Football Investor Volumes 1-6 yet, please stop and read them on Dynasty Nerds [Link]. This series aims to bring investment concepts and a different thought process to the fantasy football community.

The premise is that we should value fantasy players based on the relationship between a player’s price and his earnings. Or his P/E ratio. Price is the number assigned to him on KeepTradeCut (KTC). KTC = Price. Fantasy points-per-game (PPG) is a player’s earnings. So, putting it all together: P/E = KTC / PPG (note: divided by 10 for simplicity). When comparing similar assets (like for like), the lower the P/E, the more value you get from that player. The best way to use P/E is to look at clusters w/in each position group for value.

I’ve mentioned the following reminder in every volume of the Intelligent Investor series, and now it’s time to address it. Around mid-summer, we will roll the P/E ratio forward and move from the actual 2021 PPG to the projected 2022 PPG. Let’s do it!

From 2021 to 2022

It’s time. It’s time to leave 2021 in the past and start looking to 2022. What happened last year doesn’t matter anymore. I know you are skeptical, but hear me out. We can use what happened last year to inform our opinion about what will happen in the future. But what happens in the future is all that matters now. In dynasty fantasy football, you don’t earn points for what your players did the prior year. You don’t win leagues with players’ previous year’s performances.

Moving on from the past can be a challenging concept to understand. Most people want to think about things with actual numbers that have occurred. There is some certainty to the numbers themselves. You know that a player has performed at that particular level before. Why would you base any analysis on a ‘projection,’ an ‘estimate,’ a ‘guess’ on what production could be? Who is making those guesses? How do they come up with those ‘projections’? Please make it all make sense.

A lesson in Actual Results vs. Future Projections

This concept was a hard-fought lesson for me to learn in investing. When I first started investing, I spent a lot of time trying to understand companies and their markets. Then I learned every quarter (three months), the companies give you a report that tells you how they did. This report is called a quarterly earnings report. I thought, fantastic, this is close to a real-time check on how good a company is doing. I’ll see how well they did in the previous three months.

So first, I read a company’s press release and looked at all the numbers in the financial statements. I thought to myself, wow, this company’s earnings beat consensus by 15%, that’s amazing, just an incredible performance. Then I listened to the earnings call where management talked about the quarter and answered expert analysts’ questions. I returned from the call feeling excellent; everything was going better than expected in their operations. But the analysts kept focusing on what the company was telling us about the future. The company was estimating/guessing what was going to happen.

The Lesson

I didn’t know it at the time because it all sounded good, but the analysts understood it was not good. Although the company was projecting earnings growth, analysts and consensus were hoping for more earnings growth. The stock’s price plummeted by 10%. To me, this wasn’t very clear. The company performed well in the prior three months and beat expectations. Those were actual numbers; they happened. Then the company estimated what was going to happen in the future. An educated guess, and it didn’t meet those expectations, and the stock went lower. That’s the thing, stock prices reflect what has happened, but maybe more importantly, they reflect what’s going to happen. They tend to move around quite a bit if what consensus thinks is going to happen doesn’t end up happening.

Rolling Over to 2022 PPG

The same thing applies to fantasy football. We need to switch from what happened in 2021 to what will happen in 2022. So much goes into those projections. Starting with what happened last year as maybe a baseline, then adding the changes. Like what happened in Free Agency, the NFL draft, summer mini camp, pre-season, coach changes, coordinator changes, front-office changes, and many more factors. Then experts take all that information and make guesses/projections on what a player’s PPG will be. It’s not factual; it’s a guess. But many experts come together with their expectations, and a consensus is formed, which becomes our expectations. Players are going to outperform, underperform, or meet those expectations. But it’s vs. those expectations that will determine how prices will move.

Rolling over to 2022 PE

Inevitably, with the change of focus from 2021 to 2022, player values will change. We’ve discussed how their PPG will change. But because PPG is a part of the PE calculation, each player’s PE will also change. The biggest earrings (PPG) movers will generally correlate to the biggest PE movers. All this to say, valuations will vary with this rollover, and my recommendations will also change (more on this below). It is common in the investment world to focus on PE ratios one or two years into the future. And spend less time on what happened in the previous year.

Biggest Earnings Movers

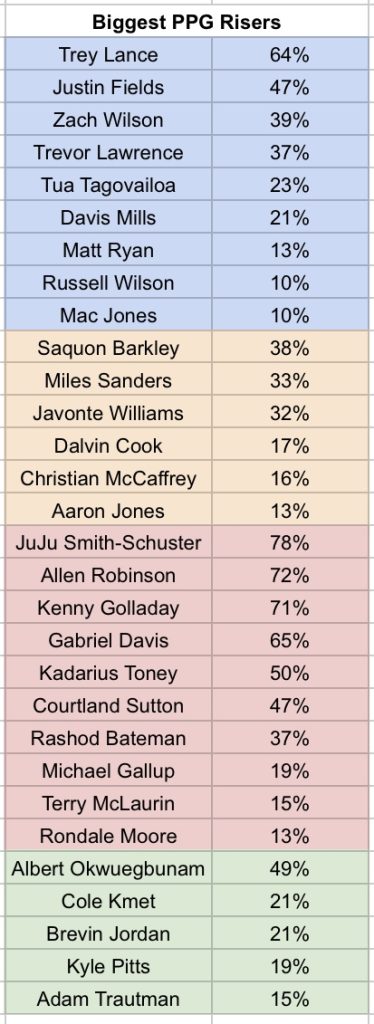

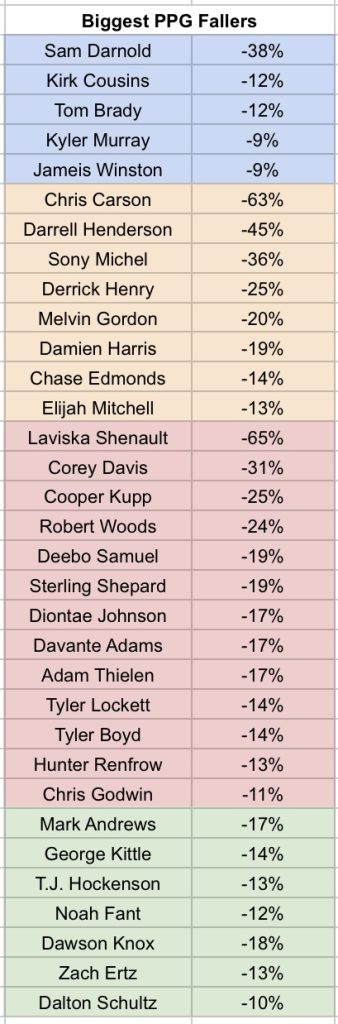

So as a reminder, my view of a player’s earnings is his fantasy PPG. One way to look at and analyze PPG would be to compare it to the previous year and see how much it has changed. In this case, we will look at each player’s projected 2022 PPG and compare that to his 2021 actual PPG on a percentage basis (the % change).

For example, Patrick Mahomes produced 21.3 PPG in 2021 and is projected to score 22.1 PPG in 2022. Mahomes’ growth rate of 2022 projected over 2021 actual is +4%. Or Kyler Murray produced 21.5 PPG in 2021 and is projected to score 19.5 PPG in 2022. Murray’s growth rate of 2022 projected over 2021 actual is -9% or down 9%. If you figure that out for each fantasy player, you can get an idea of how people think about each player’s growth/decline in PPG terms and use that to evaluate players from another perspective.

I did this for you, and the results are below. First, I’m using Pro Football Reference for the 2021 PPG like the other Intelligent Investor series. And for the 2022 projections, I’m using ESPN’s 2022 PPG projections from 6/10/22. 2022 projections will change over time based on new information, they are not static, so these growth rates will move around a bit when you get new predictions.

The Most Significant Earnings (PPG) Risers

Let’s start with those second-year QBs. Part of the reason you are seeing so much PPG growth year to year is that last year none of them put up many PPGs. Lance, Fields, Lawrence, & Wilson were all in the 11-12 PPG range for 2021, and ESPN is projecting them all to be in the 16-18 PPG range for 2022. That’s some of the most considerable earnings growth across the entire space and largely accounts for why those players trade at high prices and high PE ratios relative to their position group. Although not as much, Davis Mills and Mac Jones are getting similar bumps. Tagovailoa gets a Tyreek Hill bump, and Russell Wilson and Matt Ryan get a new (hopefully better) offense bump after they moved teams this offseason.

I can’t talk about every individual player, so I’ll call out a few, but essentially all these earnings risers make sense. You can logically determine why ESPN is projecting higher PPG in 2022 vs. 2021.

Javonte Williams, a Top Earnings Grower

Next, let’s look at Williams. In 2021 he produced at a ~12 PPG level. ESPN is now projecting he hits a 16 PPG level in 2022. That’s 32% growth!

Weekly Javonte Williams highlight.

— Denver Broncos (@Broncos) December 19, 2021: CBSpic.twitter.com/BPrkomiC9H

If you recall, back in the Intelligent Investor Vol. 3 on RBs, I wrote up Williams as a Sell. I also did a sensitivity analysis, where we looked at all different variations of PPG to see what kind of upside in price Williams had, depending on what your estimate of PPG is. Now we have an estimate of PPG, ~16 PPG. If you look at the sensitivity chart using the 2021 PE model, you get to ~4% downside using 16 PPG as an estimate.

For clarification, Breece Hall was added to his cluster between Intelligent Investor Vol. 3 and this volume. Using that 16 PPG in the 2022 PE model shows a 2% upside. Under each model, 2021 vs. 2022, Williams no longer looks like a Sell or a buy. Now he fits into my hold category. I will formally remove him from the Top Sells list today (more on this below).

And the Rest of the Risers

Barkley, Sanders, Cook, McCaffrey, and Jones are established producers who didn’t produce at past levels for whatever reason (injury, age). ESPN is projecting a bit of a reversion to what they’ve been able to do in the past.

For the WRs, a lot of their growth looks like situational changes. Juju goes to the Chiefs and plays with Patrick Mahomes in a wide-open WR room. Allen Robinson moves to the Rams and plays with arguably the best QB he’s ever played with in Matthew Stafford. Sutton gets the Russell Wilson bump. Bateman gets a potential WR1 spot with Hollywood Brown moving to the Cardinals. Terry McLaurin gets a Carson Wentz bump from ESPN, although I’m not sure that is justified. Then you have Davis, Toney, & Moore, who all scored under 9 PPG in 2021, but ESPN is projecting much better results in 2022 on these risk/reward guys.

And finally, the TEs, again primarily situation explanations, Albert Okwuegbunam gets the Russell Wilson bump. Cole Kmet is higher because Fields will have to throw the ball to somebody. And Brevin Jordan and Kyle Pitts are projected for 2nd-year step-ups.

The Most Significant Earnings (PPG) Fallers

For the QBs, I think we’d all agree that Sam Darnold makes sense here as a PPG faller; not much to say there. I’m not sure why ESPN has Cousins, Brady, and Murray falling a bit; it must be they all had great 2021 seasons, so they are baking in some reversion.

Melvin Gordon also makes sense; if you are going to increase Williams’ PPG by 32%, those points have to come from somewhere, so seeing Gordon on the largest PPG fallers list isn’t surprising. The rest of the RBs are mostly situational things, except Derrick Henry, which I’ll discuss below.

Major PPG Reversions

I talked about this many times when I gave my recommendations in previous volumes, some of my Top Buys were based on historic 2021 PPG seasons, and we should expect some reversion to the mean. Henry and Kupp had incredible 2021 PPG seasons, and I always expected their PPG projections to come down a bit for 2022. Henry’s is going from 24 PPG in 2021 to a forecast of 18 PPG in 2022. Is the age cliff here? That’s unknown, but ESPN is projecting he doesn’t get back to 24 PPG in 2022. Just like Willams above, the fall in projected earnings changes how Henry looks from a 2022 PE model perspective, and it’s time to take him off the Top Buy list. He continues to show price upside, but it no longer warrants a Buy; I’m now recommending a Hold (more on this below).

Cooper, and we cannot stress this enough, Kupp.

— Los Angeles Rams (@RamsNFL) June 9, 2022Relive @CooperKupp's top-10 plays from the 2021 season. pic.twitter.com/rsNUXefzlw

The same goes for Kupp. He put up 26 PPG in 2021, and ESPN has him projected for 20 PPG in 2022. 20 PPG is nothing to slouch at; you should be happy he is on your team, but given the rollover to the 2022 PE model, I no longer see the tremendous upside I saw using the 2021 PE model, so it’s time to move to a Hold for Kupp as well (more on this below). Don’t get me wrong, I still love Kupp; just not sure you should be out there actively trying to get more shares at the moment.

Diontae Johnson is Still a Buy Because his Price is Still Too Low

A great way to start the game

— Pittsburgh Steelers (@steelers) October 10, 2021@_BigBen7 | @Juiceup__3 |

: FOX pic.twitter.com/7H4cW61oc8

And then there is Johnson, another one of my Top Buys. According to ESPN, he is also in store for some PPG reversion. From 17 PPG in 2021 to 14 PPG in 2022. I have to say, I usually agree with 2022 projections, but here I’m afraid I have to disagree. ESPN may be thinking his QB situation didn’t improve much, but I’d have to say even though I’m not super high on either Trubisky or Pickett, it has to be better than the last few years playing with aging Ben Roethlisberger. Despite the drop in PPG estimates, Johnson still has upside, mainly because you all have pushed his KTC price down pretty low. He remains on my Top Buy list; even though his upside isn’t as high as it once was, there is still an upside to be had.

And the Rest of the Fallers

Davante Adams goes from Aaron Rodgers with very little competition for targets to Derrick Carr with at least Darren Waller and Hunter Renfrow competing for share. Tyler Lockett loses Wilson. Woods, Shepard, & Thielen are all down, presumably on an age cliff. Deebo was probably a bit of a reversion to the mean from an outstanding season last year. Viska lost his starting place in free agency this year, but if he’s traded to a better situation, I can see his PPGs getting moved back up.

And finally, the TEs. Mark Andrews had a fantastic season last year, putting up 18 PPG, and ESPN has him projected in 2022 at 15 PPG, some reversion to the mean. This doesn’t mean 15 PPG is written in stone; it’s just a guess at what 2022 could look like for Andrews. As we’ve discussed over and over again, the Wilson trade from Seattle to Denver has pushed many of the supporting cast up/down in projections. You’ve heard me discuss Wilson himself, Williams, Sutton, Okwuegbunam, Lockett, and now Fant, who gets moved to Seattle with an uncertain QB situation.

Top Picks Changes

So far, you’ve only seen me take players off the Top Picks list. In my next Intelligent Investor volume, I’ll focus on refining my 2022 PE model and examine who should be taken off and added to my Top Picks list given the rollover to the 2022 PE model. You should be expecting some changes. I’ll give you guys more ideas to create value in the space.

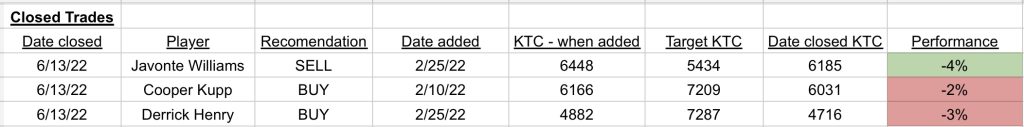

Formally removing Javonte Williams from the Top Sells list & removing Cooper Kupp and Derrick Henry from the Top Buys List

In volume 6, we removed Tyreek Hill from the Top Sells list after his price depreciated 15%, precisely as we predicted. That one worked out. It also seems like Top Buys Marquise Brown and Lenny Fournette are looking like wins.

Williams was a small win, but getting there was a challenging journey. I put him on the Top Sells list at a KTC price of ~6450 at the end of February. Then his price went up to ~6790 as the hype grew. Then the Broncos signed back Melvin Gordon, and expectations cooled a bit (just like we thought might happen), where his KTC price eventually fell to ~6190 or minus 4% from his original KTC price. So, we made ~4%, not as much as I was hoping to, but now that we are moving to 2022 PE valuations, I think it’s an excellent time to take a small win and move on to a new idea that maybe has more upside/downside.

Kupp and Henry to Hold

And then on Kupp and Henry, these recommendations I think can be chalked up as a learning experience for me. The learning experience didn’t cost much in KTC (2-3% for each), but from now on, I’m going to make sure I have a good idea about what analysts will bake in for reversion on a PPG basis because I didn’t have either of those guys’ PPGs falling that much year over year.

DERRICK HENRY WAS GONE

— ESPN (@espn) October 19, 2021

(via @NFL)pic.twitter.com/tq4Y0lYr3M

Now, I’m not going to be the guy who says the 2022 projections for these guys are wrong because I am not an expert at projections; I’ll leave that to the analysts with the correct information. But I am going to say that projections are estimates, and it is possible for Kupp and Henry to outperform. If they exceed expectations, they will look cheap again, and their prices should rise. Because I’m taking them off my Top Buys list, I would miss out on that upside. But given that there doesn’t seem to be too much upside given 2022 PE valuations, it might be best to put your money behind some guys with more upside or downside. You can only make so many bets, aiming to maximize those profits.

The Rookies

With the rollover to 2022 PPG, we can finally start looking at the rookies. The rookies haven’t been included because we have used 2021 PPG in the PE calculation, including the earnings growth analysis in this volume. But now, with the rollover, we can look at how rookies compare in value. At this time, projections for PPG will be too low because the analysts don’t know what to expect, but prices will be high, making for some high/expensive PEs. I’m excited to dig in and let you know what I find out.

Conclusion

The day I’ve been reminding readers about every volume has come, we rolled over our PE valuation model from 2021 actual PPG to 2022 projected PPG. Then we talked about some of the most significant changes in PPG year over year and why that was happening (age cliff, situation, opportunity, reversion, etc.). Then we discussed some changes to my recommendations given the rollover, including that I mentioned more changes would come in the next volume as I refine my PE model to account for 2022 PPG projections. And finally, I said the next volume would include the rookies in the analysis, which should make things interesting.

If you are interested in learning more about Dynasty/Devy fantasy football, please follow along on Twitter @_jasonstein and let me know what questions you have and how I can help.

Make sure you subscribe to the #NerdHerd, where you get exclusive content, dynasty/rookie/devy rankings, buy/sell tool, and a bonus podcast too. Dynasty Nerds also recently launched the #DynastyGM tool, a complete game-changer in the fantasy industry. Click here for a free trial. We truly are your one-stop shop for all your fantasy football needs!