Alright everyone, I’m changing it up for The Intelligent Fantasy Football Investor Vol. 5. I was supposed to discuss buy/sell ideas for the TE position group, but that’s now going to be Vol. 6. I’m pushing the TE group discussion because I wanted to talk about behavioral finance and accountability instead.

Accountability is a subject I really care about and a big part of why I started writing this series. Analysts who give buy/sell recommendations need to be accountable for them. I think it’s essential that fantasy analysts show a track record to prove why someone should take their advice. Below, I’m going to have a fun discussion on behavioral finance. Then I will provide an example of how fantasy analysts can be accountable for their recommendations.

Behavioral Finance

Much can be learned from the application of behavioral sciences to fantasy football. In Volume 1, I brought up a concept called the efficient-market hypothesis (EMH). EMH states that at any given time, the prices on the market already reflect all the known information and change fast to reflect new information.

The EMH hinges on the principle that investors act rationally. But what if investors don’t act rationally? That’s where behavioral finance comes in. Behavioral finance states that there are psychological aspects to investing and that psychological biases may affect the behaviors of investors. Essentially, behavioral finance applied to the markets means that markets are not completely efficient because sometimes investors don’t act rationally.

Let’s talk about a few of those behaviors/biases

Confirmation bias is when an investor only seeks out and accepts information that confirms what they are already thinking. Recency bias is when an investor gives greater importance to the memory of recent events and thinks those are far more likely to occur. Familiarity bias is when investors just invest in what they know, ignoring the rest. Self-attribution bias is when an investor makes decisions based on overconfidence in their abilities/knowledge. Herd behavior is when investors just tend to go along with the majority.

These are just a few of the many interesting behaviors/biases out there. And it’s easy to see how every one of those biases can inhibit an investor from optimal performance. The point is that maybe the market isn’t as efficient as I alluded to in Volume 1. And that’s because the market is created/made by people that don’t always act rationally.

The Pendulum

When investors are not acting rationally, they create a pendulum effect of euphoria and depression. A boom and a bust. This causes people to beat the drum on positive developments and torment negative ones. Once the pendulum is swinging, the asset’s price will likely move too far one way or the other. This causes the market to over/underprice assets.

This pendulum effect happens all the time in fantasy football. A rookie RB gets drafted in the 1st round by an NFL team. This particular NFL team has an excellent offense with no competition at the position. The price of that rookie skyrockets before he even plays a down in the NFL. Euphoria! The market pendulum probably swung too far to the positive. Then that same player has a couple of mediocre seasons riddled with injury and poor circumstances. That player’s price plummets, depression! The pendulum probably swung too far in the negative direction. The point here is a player’s price/value probably is somewhere in the middle of the pendulum price swings. And value can be created if you take advantage of those extreme market prices. Buy players when the pendulum swings too far to the negative. And sell when the pendulum swings too far to the positive.

Catalysts

Typically you need a catalyst for a player’s price to move up or down. If there is no catalyst on the horizon, it may be tough for you to capture a player’s fundamental value. In investing, one of the most common catalysts is when a company reports earnings. Earnings reports happen quarterly (or four times a year). For players, their earnings reports are each game played. So assuming an injury-free season, players report earnings 17 times per season. Each game would represent a catalyst to move a player’s price up or down.

Games played are not a player’s only catalyst. There are many more. For example, some common catalysts are NFL free agency, the NFL draft, coaching changes, injuries, etc. The main point is, when you are thinking about giving fantasy recommendations, it’s important to have some understanding of what type of catalysts could be on the horizon for that particular player. And this is what I want to dive further into when I hold myself accountable for my recommendations.

Accountability

In Vol. 2, I talked about a new way to give a fantasy football recommendation. To summarize, when you give a buy/sell recommendation, it should also include a target price along with potential upside/downside from current levels. This is very important because it allows the audience to understand what kind of outcome you are expecting and how much confidence you have in this recommendation.

Jay’s Top Buys Accountability

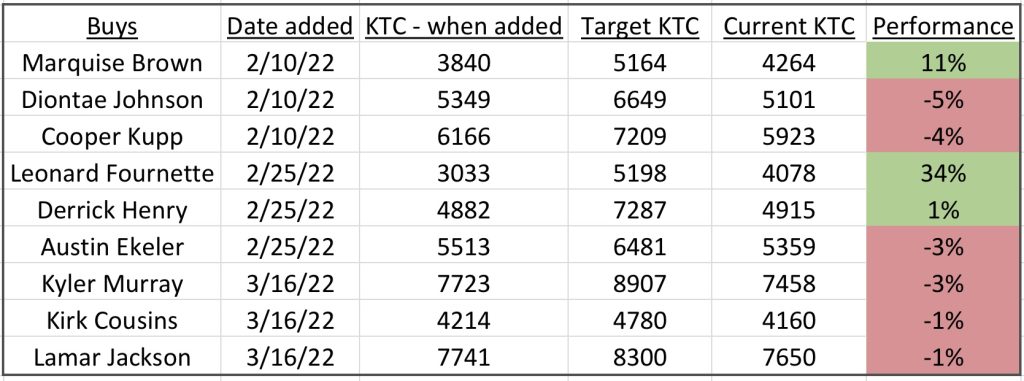

These are my top buys so far from Volumes 2-4. I included the date I added the player to the top buy list, the KTC (price) when added, and my target price using P/E valuation. I also included the player’s current KTC and performance (% difference between a player’s current KTC and his KTC when added to the top buy list). Green means that the idea has worked, and red means the trade is against my recommendation.

Two of these trades have worked well so far (Brown & Fournette). The recommendation to buy Fournette has worked to the tune of +34% so far. And looking at my price target, I think there is still more upside to go. So, I recommended buying Fournette because I said he is trading at a price cheaper than his fundamental value. But to get a player to his fundamental value, I needed a catalyst to get the player’s price to move. Fournette’s catalyst happened to be that he re-signed with the Tampa Bay Buccaneers on 3/22/22. Before re-signing with Tampa, there was uncertainty about where he might play in 2022. And if that situation would be better or worse than what it was in 2021. It turns out re-signing was a positive catalyst, and his price went up.

Marquise Brown

The Marquise ‘Hollywood’ Brown recommendation has worked as well, with +11% price appreciation since he was added to the top buys list. His catalyst is people realizing he isn’t going to retire from the NFL to pursue a career in professional video games, thankfully for us.

Cooper Kupp & Austin Ekeler

Now onto some of the buy recommendations that haven’t gone so well. I still think they will play out, but it will take time. First off, let’s start with Cooper Kupp and Austin Ekeler. These guys score a ton of fantasy points but never seem to get credit for it in their price. I see a negative catalyst coming before a positive catalyst. The negative catalyst is when we all start looking at 2022 projected fantasy points per game (ppg), most analysts will bake in a reversion to the mean in these guys’ ppg. The primary positive catalyst for Kupp/Ekeler is going to be earnings, i.e., playing games and scoring points. Unfortunately, that becomes a testament to one’s patience.

Also, on Ekeler in particular, the Chargers may add a bigger back to the mix to compliment him. To the extent that this new addition is good, he could take fantasy points away from Ekeler. Previous Ekeler compliments at RBs over the last few years haven’t been that good. My recommendation to buy both Kupp/Ekeler might move against me in the near term and be wrong for a while, but to truly judge whether I made a good recommendation, we will have to wait until these guys start playing games.

Diontae Johnson

Then there is Diontae Johnson. If you remember, I wrote that I was hoping for better QB play in 2022 than in 2021 for the Steelers. That was the catalyst I was hoping for. Well, we don’t know what the Steelers are going to do in the draft, although there is a lot of speculation that they are interested in taking a rookie QB in the 1st round. They did end up signing Mitch Trubisky, who has had a checkered past in the league. I think drafting a rookie QB could be a catalyst to getting Johnson’s price moving up or when we start to see Trubisky and Johnson play games together and score fantasy points. Again, I believe that Diontae is cheap relative to his direct peers on a P/E basis, but sometimes you have to wait for a catalyst to engage to recognize that value.

The Rest of the Buys

As for the QBs, I think a catalyst for Kyler Murray will be getting some certainty around his future with the Cardinals. Another catalyst for all these QBs could be the NFL draft in a couple of weeks, do the teams’ front offices draft players that help at WR, TE, or OL. And then the main catalyst for all of them will be earning fantasy points during the season. There are so many catalysts that can move prices, but which are the ones that do, only time will tell. That’s why it’s super important to trust that you value these guys appropriately and then have the patience to see the idea come to fruition.

Jay’s Top Sells Accountability

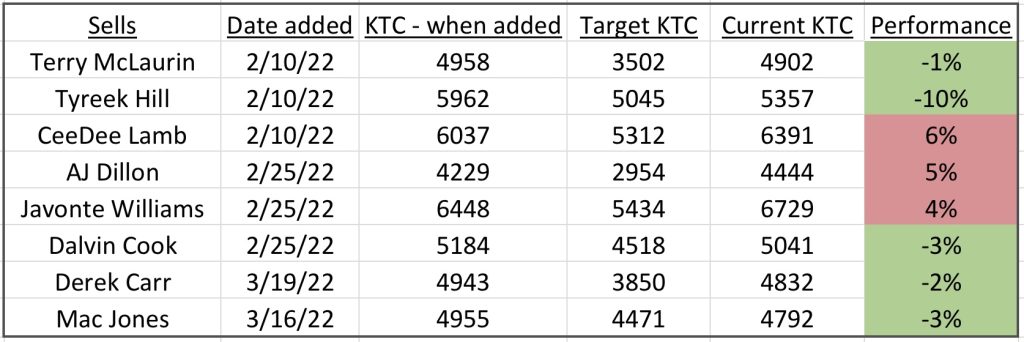

These are my top sells so far from Volumes 2-4. Again, green means that the idea has worked, and red means the trade is going against my recommendation.

These guys make the top sells list because of their valuation on a P/E basis. They scored fewer fantasy points than their respective peers at their given prices. The majority of these ideas have worked so far. Currently, the best-performing idea is minus 10% from Tyreek Hill. His catalyst was his trade from the Kansas City Chiefs to the Miami Dolphins. To state the obvious, he is downgrading at QB, from Patrick Mahomes to Tua Tugavaolia. Here is my thread on Twitter about the impact of this trade on Tyreek and others:

My

— Jay Stein (@_JasonStein) March 23, 2022on the Tyreek trade from a fantasy perspective:

Going from Mahomes to Tua is a downgrade. Going from the Chiefs offense to a McDaniel offense may not be that much of a downgrade. Assumptions: McDaniel’s offense = 2021 49ers offense & market share = 50/50 Dominator. [1/5] pic.twitter.com/JH8VIk9qwj

The conclusion is that to achieve similar production year over year, Tyreek would have to achieve ~30% market share (50/50 dominator) of the new Mike McDaniel Dolphin’s offense. And that’s compared to the ~25% market share he had of the Chiefs’ passing offense last year. It’s doable, but I think it’s apparent that the market is pricing in that Tyreek will score fewer points, given his price has come off 10% since the trade.

Derek Carr

I gave myself the Derek Carr KTC price of 3/19/22, when Volume 4 was published, which happened to be after the Devante Adams trade to Vegas. So, that idea is looking OK at the moment, as well as Terry McLaurin, Dalvin Cook & Mac Jones trades. We still need some catalysts to get these guys prices moving. For McLaurin, maybe that is playing with his new QB Carson Wentz. And for Cook, perhaps that is Father Time catching up with him. For Mac Jones, his catalyst probably doesn’t come until we start seeing him play games and see if he lives up to and improves on what he was able to do his rookie season.

Ceedee Lamb

And now the ones that haven’t gone well. Ceedee Lamb had a positive catalyst in that Amari Cooper was traded to the Cleveland Browns, making room for Ceedee to become a larger part of the Cowboy’s offense. I think it’s probable that the Cowboys will add another WR to the mix, most likely through the draft (my guess is former Arkansas Razorback Treylon Burks). Whether a WR gets added via the NFL draft or free agency, I think it will be a negative catalyst and move Ceedee’s price downward.

AJ Dillon & Javonte Williams

Then there is AJ Dillon and Javonte Williams. In Vol. 3, we walked through a scenario analysis on AJ and a sensitivity analysis on Javonte. The negative catalyst for AJ Dillon will be sharing his workload with Aaron Jones and staying in the committee back cluster for this year. It’s also possible that he takes over the backfield and trades at a higher P/E, but that is priced into his current price. So I’m thinking there is limited upside and a large potential downside.

And then there is Javonte. Using the sensitivity analysis, we determined that if he scores 18+ ppg in 2022, he is undervalued, but if it is anything less than 18 ppg, he is overvalued. The primary catalyst to whether this happens or not is what the Broncos decide to do at the RB position group. Do they bring back Melvin Gordon to share the workload with Javonte? Do they add a different veteran RB or draft an RB to compliment Javonte? Or does Javonte end up owning the entire Broncos backfield? If Javonte ends up owning the backfield, is he good enough to become one of the premier RBs in the NFL? I guess that Javonte, to some extent, will be sharing the backfield and that he is currently overpriced. Just have to wait for one of these catalysts to play out.

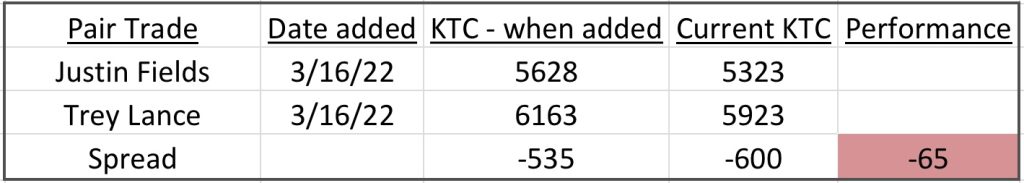

Jay’s Pair Trade Accountability

This is how my pair trade idea from Volume 4 is doing. I’m down a little bit.

The main catalyst I see for Trey Lance is whether the 49ers make him the starter or not for the 2022 season. Much of that is contingent on what they decide to do with Jimmy Garoppolo, the 2021 starter. The 49er’s offense is already pretty good, so I don’t think there is much of a catalyst for Lance from adding players to the offense via free agency or the draft. It seems that Lance is already getting some credit for being a good starting QB in a great situation.

As for Fields, we have a pretty good idea that he is the starter for the Bears in 2022, even with the regime change in Chicago. The main catalyst for him is what the Bears’ front office and coaching staff do to help Fields succeed in his sophomore campaign. It doesn’t look like they have done much thus far in free agency. Hopefully, they can get Justin more weapons and better blocking in the draft and the latter part of free agency.

As a reminder, a pair trade isn’t about setting a price target. It’s about two similar assets being valued differently and thinking that valuation differences should converge over time. Either Trey Lance’s price declines or Fields’ price appreciates, and/or they meet somewhere in the middle. Again this one may take a little time to play out or could work fairly quickly. Time will tell.

Track Record

The purpose of this volume was to discuss holding analysts accountable for their recommendations. This is incredibly important so the users of those recommendations know the analyst’s track record. If we don’t know an analysts’ track record, how are we supposed to know who’s advice to follow? It’s not about just getting one call right and ignoring the rest of your bad calls. Or about getting most of your calls right but getting dragged on the one or few calls you got wrong. I plead and implore fantasy analysts to use this process to show a track record or develop their own way to show their track record. If it’s not about KTC prices, you could keep track of where players move around on average draft position (ADP) or what their ppg ends up being vs. your expectations. Or you can simply give yourself green checkmarks for correct predictions and red Xs for incorrect predictions.

Who better to hold you accountable than yourself? Don’t make others do it for you. Let’s establish more accountability and keep track of the good and especially the bad calls. It will make us all learn more and become better dynasty players.

Conclusion

This volume is about the behavioral sciences and how certain behaviors/biases create inefficient markets that we can create value from. We talked about how these biases can lead to a pendulum effect that can cause a market to under/overprice players. Then we discussed catalysts, what they are, and how they are an important part of price changes. And finally, how to be accountable for the recommendations you or fantasy analysts make. We need to explicitly understand analysts’ track records for us all to learn and get better.

Next in this series, we will look at buys and sells in the TE group. For real this time. I’m looking forward to slicing up the position and giving you guys some real actionable advice to help you win your dynasty fantasy football leagues.

That’s it for now. Please follow along on Twitter @_JasonStein and let me know what questions you have and how I can help. “Use promo code “INVESTOR” for 15% off any Dynasty Nerds membership.”