This series builds off each volume, so if you haven’t read The Intelligent Fantasy Football Investor (IFFI) Volumes 1-9 yet, please stop and read them on Dynasty Nerds [Link]. This series aims to bring investment concepts and a different thought process to the fantasy football community.

The premise is that we should value fantasy players based on the relationship between a player’s price and his earnings. Or his P/E ratio. Price is a player’s KeepTradeCut (KTC) number. KTC = Price. Fantasy per-game (PPG) points are a player’s earnings. So, putting it all together: P/E = KTC / PPG (note: divided by 10 for simplicity). When comparing similar assets (like for like), the lower the P/E, the more value you get from that player. The best way to use P/E is to look at clusters w/in each position group for value.

Before we get into the IFFI update, I’d like to talk about how I use the IFFI process to trade.

This is how I trade using IFFI

The first step, make sure the trade balances on keeptradecut.com’s trade calculator. The critical part here is both the buyer and seller are paying current market prices. It doesn’t matter what your perspectives are on players; if it doesn’t balance from a KTC perspective, then both sides aren’t considering current market sentiment.

Here is where I try to benefit. I want to buy guys that are undervalued and sell guys that are overvalued relative to their current KTC. I use the IFFI process to find mispricings in current KTC levels. So the deal gets done at current prices, but hidden in the deal is the potential to add KTC to your side of the trade because, presumably, you are buying guys where their KTC will appreciate and selling guys where their KC will depreciate.

Let’s look at an example

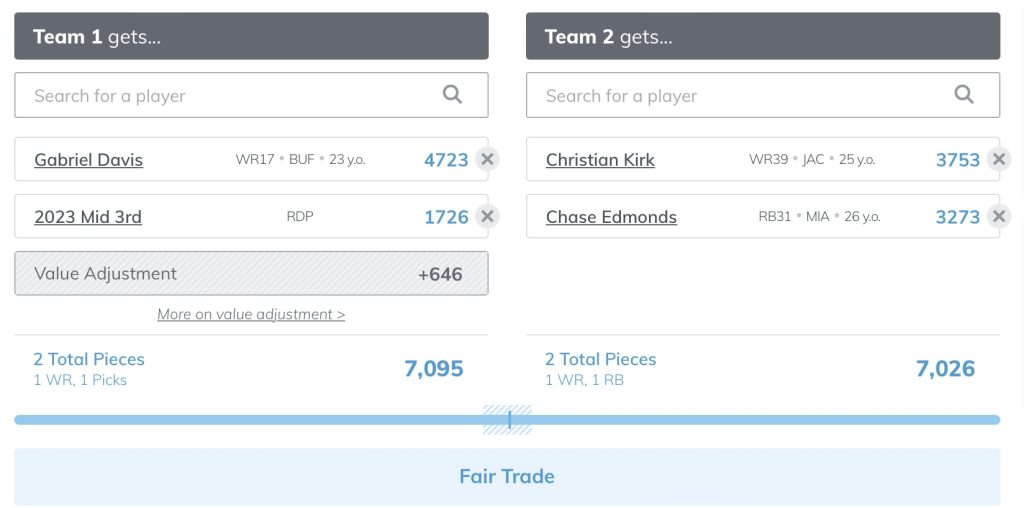

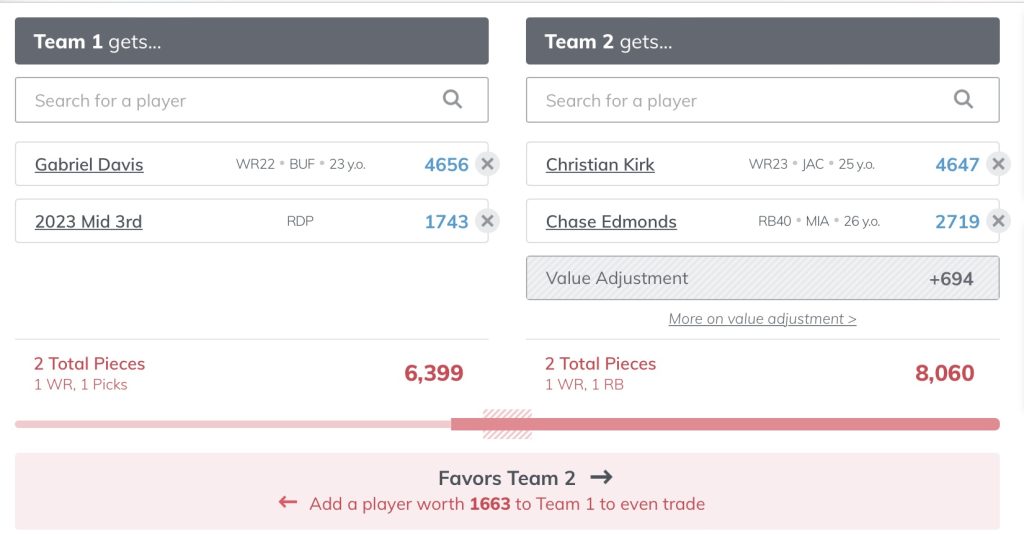

Here is a trade offer that a fantasy player asked me to evaluate a couple of weeks ago: Gabe Davis + 2023 3rd = Chase Edmonds + Christian Kirk. I will walk you through how I thought about this trade and then update you on how it looks now.

First, it balances on KTC (reminder, this was a few weeks ago). KTC says Fair Trade.

Now on to the IFFI process, WR wise this is exactly what I’m looking for, Gabe Davis looked overvalued at the time, and Christian Kirk looked undervalued. So even though the trade balances right now, I guessed that Kirk would appreciate from a KTC perspective and Davis would depreciate from a KTC perspective. This adds future KTC to your side of the trade.

Here were their Price Targets at the time: Gabe Davis: TP = 3450 (-27% downside). Christian Kirk: TP = 4325 (15% upside). If I’m right, Gabe will fall in KTC by ~1000 KTC, and Kirk will appreciate by ~575 KTC. That’s like adding 1500 KTC to your side of the trade. Chase Edmonds was slightly undervalued (~3%) at the time, but that’s not enough to add value; he’s trading at a price he should; he was fairly valued.

Example Cont’d.

Let’s take a look at where we are now, two weeks later:

As you can see, two weeks later, now the trade favors the Kirk side, just as we hoped. Gabe Davis’ KTC was 4723, now it’s 4656, where he lost ~70 KTC or down ~1.5%. Christian Kirk’s KTC was 3753, now it’s 4647, where he gained ~900 KTC or up ~24%. Chase Edmonds’ KTC was 3273, now it’s 2719, where he lost ~550 KTC or down ~17%.

So from a WR perspective, the trade worked perfectly. But in total, the exchange only added ~260 KTC, not perfect, but helpful. The miss was thinking that Chase Edmonds was reasonably valued and writing him off as not having much impact on the trade. But that’s hindsight, and we would have never made the trade without Edmonds because it would violate rule one, which is always to ensure the trade balances from a KTC perspective. The better call would have been to go Gabe Davis = Christian Kirk + 2023 Mid 3rd and leave Edmonds out of the deal.

Example results cont’d.

I’m looking at this as a win because we added KTC. Another way to think about it is if you were to reverse the trade right now, you would have to add another piece to the Davis side, which, if nothing else, would make you better off by a piece than if you had done nothing. Oh yeah, one other thing, I still think Davis is overvalued, and his price will depreciate; it’s just that it hasn’t been recognized yet. If Davis’ price goes to where I think it could, that would add even more KTC to the 260 favorable results.

To sum up, make sure the trade at least balances from a KTC perspective. Buy undervalued players and Sell overvalued players, which adds future KTC to your side of the equation. And finally, I haven’t talked about this yet, but keep in mind that picks are appreciating assets, so if you give away draft picks, that’s a loss of future KTC and vice versa.

IFFI Update

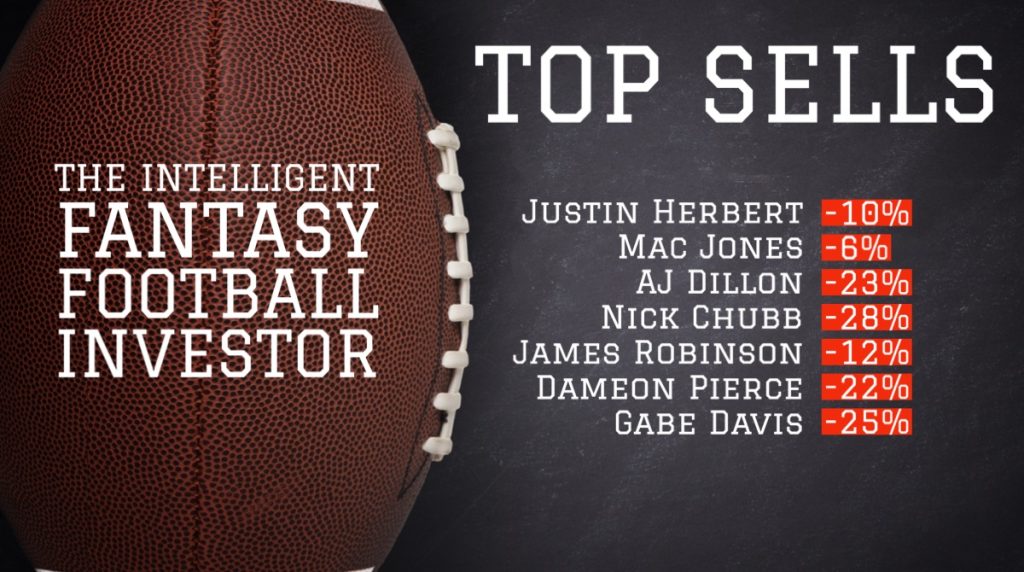

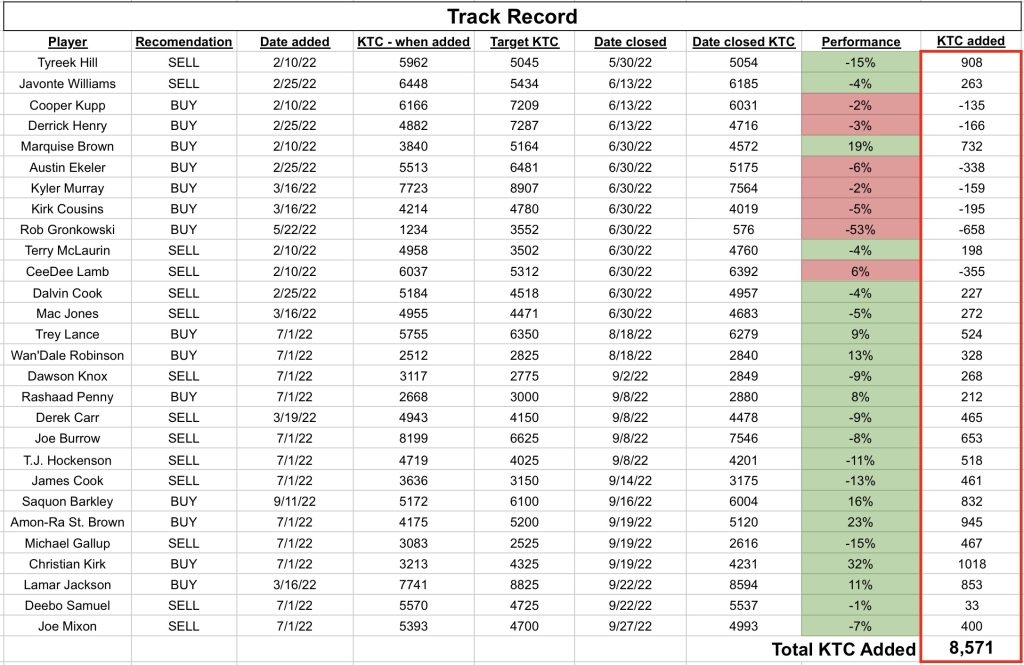

I’ve made a few upgrades/downgrades on Twitter since Vol. 9 was published, and I wanted to share a brief update on those changes. Downgrades from Buy to Hold: Saquon Barkley (+16% favorable), Amon-Ra St. Brown (+23% favorable), Christian Kirk (+32% favorable), & Lamar Jackson (+11% favorable). Upgrades from Sell to Hold: James Cook (-13% favorable), Michael Gallup (-15% favorable), Deebo Samuel (-1% favorable), & Joe Mixon (-7% favorable). See the track record below for a full picture of these trades.

Now onto the rating changes I’m making today.

Summary of today’s IFFI rating changes:

Upgrade to Buy: Kyler Murray, DJ Moore, Wan’Dale Robinson, & David Bell

Downgrade to Hold: N/A

Upgrade to Hold: N/A

Downgrade to Sell: James Robinson

Upgrade to Buy

Kyler Murray: Target Price (TP) = 8200 (+22% upside)

DJ Moore: TP = 5350 (+21%)

Wan’Dale Robinson: TP = 3250 (+28%)

David Bell; TP = 2600 (20%)

Kyler Murray

Craziest 2-point conversion we've ever seen! @K1

— NFL (@NFL) September 18, 2022: #AZvsLV on CBS

: Stream on NFL+ https://t.co/FVZamC6mMP pic.twitter.com/LdwcnQQr8S

In my opinion, Kyler belongs in that top tier of QBs, but he trades at about a 3000 KTC discount to the rest of his peers. Admittedly the situation in Arizona could be better. The Cardinals’ offensive game plan could be more inspired, and they are playing without their best receiving threat in DeAndre Hopkins, who should be back in a few weeks after his suspension. This is precisely the type of situation you look for using the IFFI model, a top-tier player that scores a ton of points but is way out of whack regarding KTC, so you get him for a bargain. As my five-year-old daughter says, “Easy peasy, lemon squeeze.” I see 22% upside from current levels, and he’s a top Buy.

DJ Moore

Baker Mayfield finds a wide open DJ Moore for six! @Panthers lead, 13-6. #KeepPounding

— NFL (@NFL) September 18, 2022: #CARvsNYG on FOX

: Stream on NFL+ https://t.co/AsnVnknkw6 pic.twitter.com/Uyoz6mrmDn

Tale as old as time, DJ Moore looks undervalued for another year. I always figured Moore was pretty good but hampered by poor QB play during his NFL career. Unfortunately, this year might be another year of poor QB play on a struggling Panthers offense. But this IFFI process is from a dynasty perspective, and the hope is that DJ gets utilized like I think he can be at some point. For now, you are buying a good WR at a reasonable price. I see 21% upside from current levels, and he’s a top Buy.

Wan’Dale Robinson

Wan’Dale Robinson is going to be what the Giants thought Kadarius Toney would be. pic.twitter.com/nFA458ZqpD

— Andrew Harbaugh (@AndrewHarbaugh_) May 26, 2022

My first repeat. Robinson was a Buy in July; then in August, I closed the trade for a 13% gain in KTC. Given his injury to start the season, Wan’Dale’s KTC has drifted back down to 2500, right where he was last time I had a Buy on him. So let’s roll the trade out again. Hopefully, Robinson will be back from his injury in week four or five, and with minimal top-level talent ahead of him, look for him to start producing immediately. I see a 28% upside from current levels, and he’s a top Buy.

David Bell

Rookie WR David Bell gets his first catch as a pro!

— NFL (@NFL) August 21, 2022: #PHIvsCLE on @NFLNetwork (check local listings)

: Stream on NFL+ https://t.co/GH49hZ3d4L pic.twitter.com/UsJjT1hLoJ

Bell was a solid prospect coming out of college. He has excellent measurables in terms of height/weight/BMI. Bell produced very well in college, including breaking out early (18 years old) and being an early declaration to the draft. He has good draft capital, as he was selected in the third round by the Cleveland Browns. The only area he missed was athleticism, as he didn’t test as fast and athletic as expected during the NFL draft evaluation phase. Not a death sentence in my book. I think the Brown’s offense could look very different at the end of the season with Watson coming back from suspension, and I think Bell could be a significant beneficiary of those changes. I see 20% upside from current levels, and he’s a top Buy.

Downgrade from Buy to Hold

No downgrades from Buy to Hold today as those were taken care of between volumes. See the track record discussion below.

Upgrade from Sell to Hold

No upgrades from Sell to Hold today as those were taken care of between volumes. See the track record discussion below.

Downgrade to Sell

James Robinson: TP = 3800 (-12% downside)

On 4th down from midfield, @Robinson_jamess takes it to the house

— NFL (@NFL) September 25, 2022#DUUUVAL

: #JAXvsLAC on CBS

: Stream on NFL+ https://t.co/DpipbWDRkA pic.twitter.com/27Ewy3Gsqg

James Robinson is a tough sell because I like him and think he’s pretty good. His upside is limited as he shares the backfield with Travis Etienne and will for a while. It’s just that he’s currently trading at similar KTC prices as Derrick Henry, Alvin Kamara, Aaron Jones, Dalvin Cook, Leonard Fournette, and many others. To me, that seems a little out of whack. That’s a reluctant Sell for James Robinson. And remember, this is dynasty, not re-draft fantasy football. I see 11% downside from current levels, and he’s now a top Sell.

Summary of IFFI recommendations:

Upside/Downside IFFI Players

Here are some players I think have valuation upside but weren’t added to the Top Buys list for whatever reason: Deshaun Watson, Ceedee Lamb, Marquise Brown, Cortland Sutton, DeAndre Hopkins, Jarvis Landry, & David Njoku.

Here are some players I think have valuation downside but weren’t added to the Top Sells list for whatever reason: James Cook, Mike Williams, & Dawson Knox.

IFFI Track Record

So far, I’ve closed out 28 trades, and 21 of those 28 worked, a ~75% hit rate. Not bad. Looking at the last column, you can see how much KTC was gained or lost by each closed transaction and add it together; it totals ~8,500 KTC of added performance. Not bad at all. That’s the goal here; making you KTC.

Down the rabbit hole

I’ve done nine volumes on P/E so far. Ten if you include this volume. Sometimes you must try new things and experiment with new ideas, not knowing where they will lead you. And this past month, I went down the rabbit hole, looking at a few new concepts. As a side note, I laugh every time I type rabbit hole because I currently have a pesky rabbit that keeps digging a hole under our front porch, and we just can’t entice him to leave. Anyway, of the many ideas explored, here are some new ideas I felt were worth sharing: the Price-to-Sales ratio (P/S) and incremental margins. I’m talking about them here because I think they are fun ideas worth checking out, but they are definitely at the early stages of development so take that for what it’s worth.

Just like the P/E ratio, the P/S ratio is another way to look at how to value a player. The price would be the same, KTC. And sales would be a player’s opportunity. For example, for WR, a player’s opportunity would be his targets and carries. Opportunity means anytime a player is given a chance to earn fantasy points.

And Incremental margins would be a way to measure how effective a player is at converting opportunity into fantasy points. It would be the change in a player’s opportunity divided by the change in a player’s fantasy PPG. Both concepts are very early, but I’m excited to talk more about these ideas later.

Conclusion

That’s it! So excited I made it to double digits volumes in the IFFI series. Thank you for continuing to read. We’re starting to see some real value added; let’s keep it going. Today we talked about how I use the IFFI process to think about trading. We closed out a few favorable trades and added a couple of new Buys and Sells to the top picks lists. And finally, I introduced some new topics in the P/S ratio and incremental margins to think about for the future.

If you are interested in learning more about Dynasty/Devy fantasy football, please follow along on Twitter @_jasonstein and let me know what questions you have and how I can help.

Use promo code “INVESTOR” for 15% off any Dynasty Nerds membership.